Foreign investors of Samsung C&T have emerged as a challenger against the merger plan with another Samsung affiliate Cheil Industries.

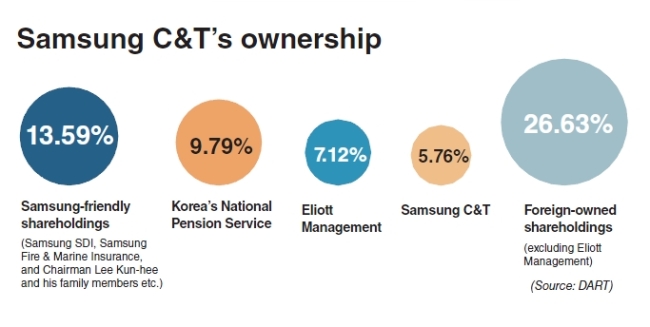

While U.S.-based hedge fund Elliott, Samsung C&T’s biggest foreign investor with a 7.12 percent stake, is seeking allies to veto the merger at the July 17 shareholders meeting, Samsung managers are striving to call in its friends in order to secure what they call “managerial rights.”

In the latest move, Elliott said Tuesday it had filed a court injunction against Samsung C&T ― the trading and construction arm of Samsung Group ― and its management from holding the shareholders meeting to stop the merger.

“Elliott continues to believe that the proposed takeover is clearly neither fair to nor in the best interests of Samsung C&T’s shareholders, and that it is unlawful. Elliott has, therefore, taken the step today of commencing legal proceedings,” it said in a press release. Tuesday was the last day allowed to buy shares of Samsung C&T with voting rights before the company freezes the major shareholders’ list for the July 17 meeting.

Since its discourse on purchasing a 7.12 percent stake in Samsung C&T on June 4, Elliott has reportedly been seeking fellow shareholders who sympathize that the merger deal ― where Cheil will acquire Samsung C&T by offering 0.35 new shares for each share of Samsung C&T ― is detrimental to their interest.

Elliott claims that the preferred stocks of Cheil Industries that discerned the exchange ratio have not yet been listed and therefore, the 0.35:1 exchange rule should be readjusted to be more favorable to C&T, whose preferred stocks fetch a higher market value than those of Cheil.

The hedge fund has sent letters to major investors including Korea’s National Pension Service to veto the merger. Some 800 domestic minority shareholders of Samsung C&T said they would back Elliott in the veto.

The Dutch national civil pension fund APG earlier this week also called for the revision, but remained reluctant to join Elliott’s move.

Many others, especially foreign investors, including institutional and pension funds, have expressed similar concerns and are expected to join Elliott, which has similar experiences in dealing with “unlawful” business practices, industry watchers said.

Samsung C&T’s foreign investors, whose combined stakes reach 33.75 percent, also include Black Rock with 2 percent, Dimensional Fund with 1.3 percent, Vanguard with 1.2 percent and Norges Bank with 1.1 percent.

“Most foreign investors are coy about their plans, so we can’t predict their stance. But the situation is not making it easy for Samsung to push forward its merger plan as expected,” a stock analyst said.

Industry sources said Samsung needed to secure around 47 percent of the stakeholders’ support to push the merger plan with ease.

Samsung C&T president Choi Chi-hun reportedly flew to Hong Kong to meet with foreign investors. Cheil Industries president Yoon Ju-hwa and several key managers have also been appealing to other investors.

Rumors have emerged that C&T would have to sell treasury stocks to its partner or affiliate firms to garner enough support. C&T denied the allegation.

“Currently, the National Pension Fund, Samsung C&T’s largest shareholder with a 10 percent stake, has reportedly been favorable of the merger plan. Therefore, there should be little to worry about in the merger,” another analyst said.

“But this will teach Samsung a good lesson,” he added.

“There is little we can say at the moment. When Elliott shows us the cards, we will be able to take action,” a C&T spokesman said. “But what I can say for sure is that Samsung has been preparing for this for a long time and we have thought of all possible scenarios, too.”

By Bae Ji-sook (baejisook@heraldcorp.com)