Bloomberg reported on the 30th (local time) that “cost-effectiveness replacements” are emerging as a new consumption trend mainly among young people as China’s economic slowdown is prolonged. It is a new word that means “cost-effectiveness replacement.” It seeks practicality and cost-effectiveness. Cost-effectiveness replacements are different from fake ones, which are made by copying famous brands and trying to make them mistake them for luxury goods. For example, Japan’s SK-II facial treatment essence 330mm costs 1,700 yuan, but local brand Chando, which contains similar ingredients, costs 569 yuan. It is one-third of the price, but it is not a cheap product.

Maison Margiela’s Ring (left) and a 369 yuan similar design ring sold by local Chinese company Sudrov / Photo = Taobao Analysts say the rise of cost-effectiveness replacements is the result of China’s development of the manufacturing industry, which makes it easy to convert imported goods into domestic replacements, and the need for young people who consider cost-effectiveness due to economic downturn and job insecurity. Related sales are also surging. According to Hangzhou Zi Technology, a data analysis firm, some alternative brands such as Chic Jock and Vailan (Jewelry) in China’s e-commerce platform saw their growth rate rise from double to triple digits in the year leading up to July this year. Citoy, a Chinese handbag maker that used to supply bags to global luxury goods companies such as Toomey and Michael Kors, recently transformed its Dongguan factory building into an e-commerce showroom to prepare to launch alternative products. Purchasing cost-effective replacements is nothing to hide from Chinese consumers. Online posts are pouring out to find items for cost-effective replacements and share the most similar cost-effective replacements to luxury goods.

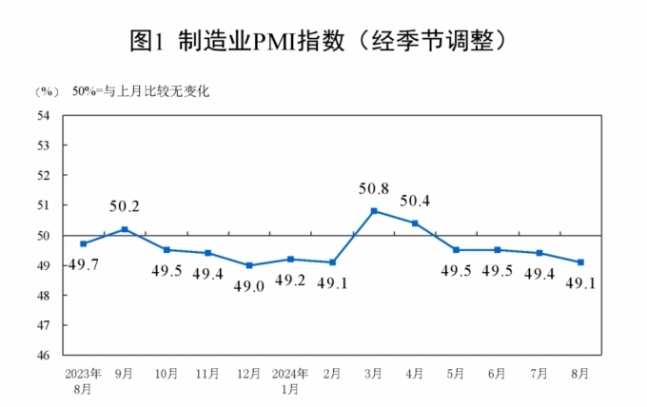

A series of live shopping videos promoting the quality and price range of cost-effective replacement items are flocking to consumers who want to order the same items. Bloomberg pointed out that the trend is different from the decades in which local companies have been ridiculed by middle-class shoppers for selling counterfeit goods while selling cheap alternatives to luxury goods. Bloomberg predicted that the rise of cost-effectiveness replacements will be the hardest hit by global brands that are highly dependent on the Chinese market. Meanwhile, the purchasing managers’ index (PMI) for August, which was released by China’s National Bureau of Statistics on Thursday, was 49.1, 0.3 lower than the previous month. A PMI below 50, which indicates economic trends, indicates economic contraction. As a result, China has been in a state of economic contraction for the fourth month and has been on a downward trend since May (49.5). Amid the still large aftermath of the property slump, UBS recently lowered its forecast for China’s growth rate this year to 4.6 percent from 4.9 percent.

EJ SONG

US ASIA JOURNAL