In the United States, the MZ generation (born in the early 1980s and early 2000s) entered the age of marriage, causing a change in the market for expensive wedding dresses.

Fast fashion companies have entered the wedding market one after another, allowing brides-to-be to buy wedding dresses as if they were choosing a T-shirt.

CNN reported on the 12th (local time) that American fashion companies are selling inexpensive wedding dresses one after another in line with the trend of the MZ generation to reduce wedding costs.

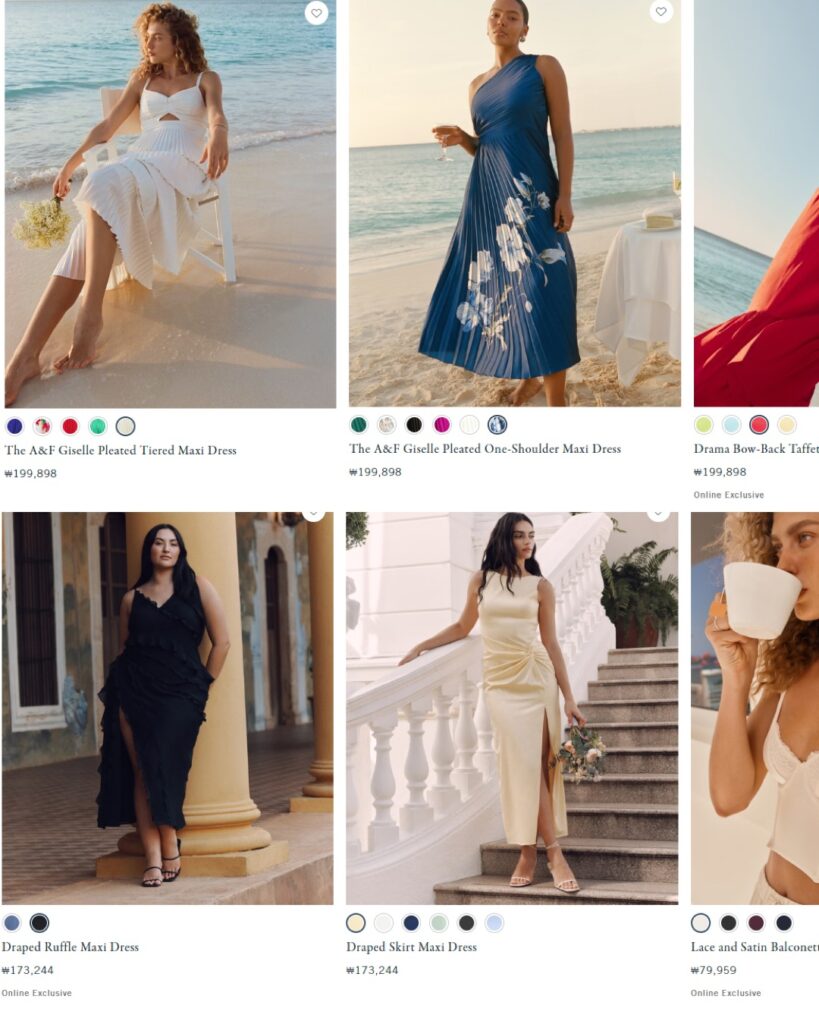

Fashion companies such as Abercrombie, Forever 21, Boot Barn, Shine, and Luluth are offering wedding dresses that cost less than $50 instead of expensive wedding dresses, which typically cost more than $1,000.

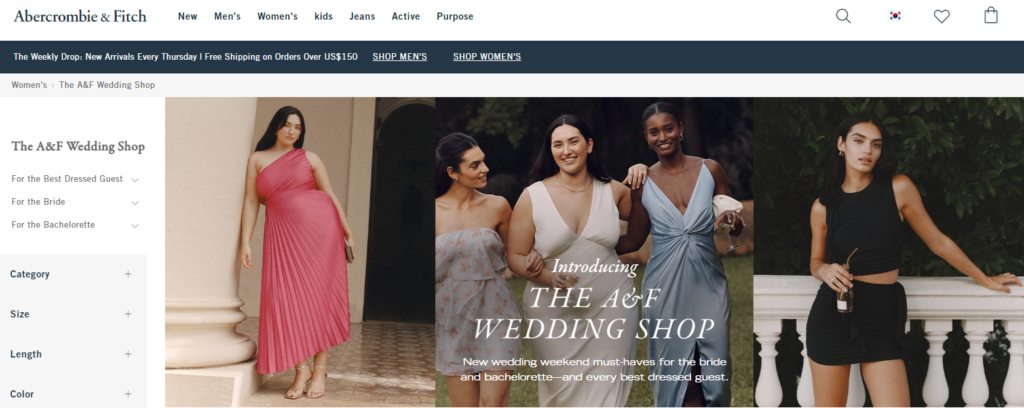

Abercrombie launched the “A&F Wedding Shop” in March and offered more than 100 products for brides and guests, including wedding dresses, for about $80-200.

In April, Forever 21 also released wedding-related products such as dresses and pajamas from $9 to $50 and white dresses that can be worn as wedding dresses are in the $20 range.

California-based Lulus also opened a store in Los Angeles in February selling wedding dresses at prices ranging from $100 to $270.

Xu, a Chinese online shopping mall, also sells wedding dresses that cost an average of $50 to $100 and up to $200 in total.

Boot Bando, a fashion company that sold Western concept clothing and shoes such as cowboy boots, joined the trend and introduced wedding dresses, cowboy boots and hats that cost less than $400 (540,000 won).

CNN reported that the cost of these companies’ wedding dresses is very high compared to the average US wedding dress cost of $2,000 last year.

It is analyzed that this change is occurring as the MZ generation, especially the Z generation, reaches their marriageable age.

This is because Generation Z, who has just reached their mid-20s, wants to abandon the existing method at the wedding and save more money while saving their individuality.

“The cost-of-living crisis has affected Gen Z, and they are feeling anxious about their financial conditions,” said Alison Reese, strategist at Wirth Global Style Network (WGSN), a fashion market analyst. “Fast fashion, which has seen a significant increase in market share over the past few years, is taking advantage of the demand for cheaper wedding outfits.”

If fashion companies want to succeed in the wedding market, they must “use the way Generation Z shops,” he said, adding that “Wearing wedding dresses offline is a tradition that Generation Z still wants to participate in.”

Various fashion companies are using online to make a variety of dresses at low prices to meet consumer demand. However, it is also necessary to consider the problem of street fashion, which is indiscriminately thrown away after purchasing at a low price.

SALLY LEE

US ASIA JOURNAL