Temu, a subsidiary of Chinese e-commerce company Pinduoduo Holdings, is a shopping mall that sells virtually everything from daily necessities to clothing and electronic devices at an “ultra-low price.” By selling wireless earphones for just $4 and a pair of sneakers for $8,000, even ordinary people can shop without worrying about money. “On our platform, every day is Black Friday (the last Friday in November, when retailers across North America have the biggest discounts of the year),” Temu says. In March last year, six months after entering the U.S., Temu exceeded 1 million monthly active users (MAU). This is a huge speed compared to the two years it took for Shine, a Chinese shopping mall that mainly sells low-cost clothes, to achieve the same MAU. As of January, market research firm Sensor Tower estimated Temu’s MAU at 51.4 million. Amazon, the undisputed No. 1 player in the U.S. e-commerce market, had 67 million. The gap between the two, which was close to 60 million in January 2023 alone, has narrowed to 15 million in a year. There were companies that had low prices even before Temu. However, Temu’s secret to growth is also a subject of study in the United States, as no other company has penetrated into the lives of Americans in a short period of time like Temu. How did Temu capture the United States? Could its popularity be sustainable? A scene from a commercial that was aired during the Super Bowl last month by China’s ultra-cheap shopping mall Temu. It tells the story that Temu is using magic to make things we use super-cheap. When talking about the secret to Temu’s growth, the so-called “offensives of advertising.” The Wall Street Journal recently made such a diagnosis in an article highlighting his growth. “There is no one who can use the Internet who has never seen a Temu commercial.” This is not an exaggeration. At the Super Bowl last month, which was watched by more than 120 million people around the world, 30-second Temu commercials were exposed six times. The Super Bowl is the most expensive in the world, and it is known that it usually costs around 7 million dollars to air one episode. If six episodes were aired, they would have spent 42 million dollars. It is estimated that Temu spent about 1.7 billion dollars on advertising last year. This year, Temu is expected to spend nearly twice as much as 3 billion U.S. dollars. In order for its competitors to occupy advertising spots with great promotional effects, it has to spend more than Temu. Knowing this, Temu is slowly “testing” its competitors by blocking other companies’ opportunities to advertise by spending huge amounts of advertising money. According to Gupta Media, an online ad tracking firm, Facebook’s advertising price, which reached 1,000 people as of September last year, has increased by 24 percent year-on-year, with Temu being blamed as the main culprit for the inflation. Josh Silverman, CEO of Etsy, a U.S. online marketplace that trades second-hand clothes, told the WSJ that Temu is having a significant impact on advertising costs alone.

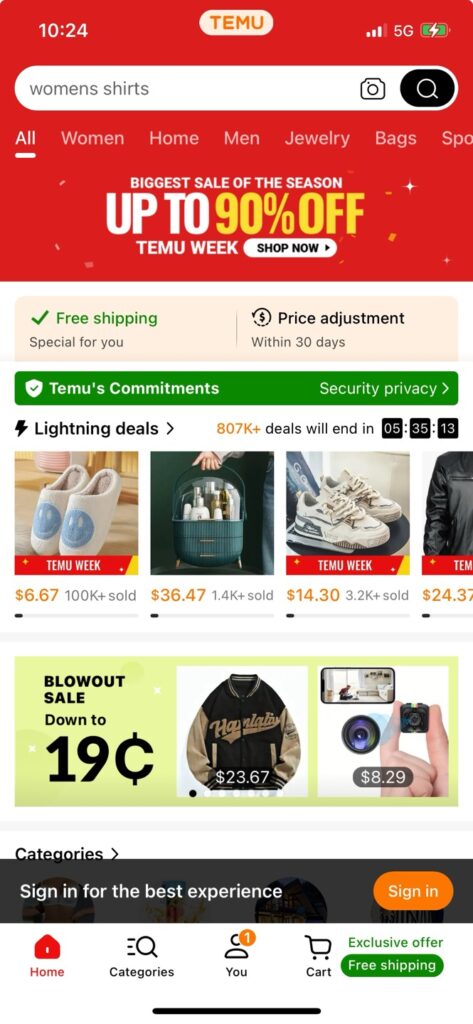

Once it is introduced to the Temu platform through advertisements, it is difficult to resist temptation. Products that are extremely cheap compared to the U.S. prices, such as a portable humidifier in the $1 range, a set of five pairs of socks in the $2 range, and a pure cotton blanket in the $10 range, are labeled as “limited sales” to encourage purchases. Temu’s strength is that it is not limited to silk. Dollar General and Dollar Tree, also known as the 1,000-won shop in the U.S., sell products with prices similar to those of Temu, but there are also monotonous or crude designs. Temu’s products, on the other hand, have many cute and pretty things. “Temu gives away cheap items while satisfying your desire for something new,” said Wendy Wooloson, a professor at Rutgers University in the U.S. “It doesn’t matter if Temu’s products aren’t as good as expected because it provides an stimulating shopping experience.” On top of that, Temu gives away discount coupons and delivers them to their homes for free with just one dollar purchase. It also supports compensation for delayed delivery and unconditional free returns. When discount coupons are applied, the prices of other products in your shopping cart are slightly higher than before, but not many users know this fact. Since all orders are delivered directly from China, it takes more than a week on average, but most of them do not feel uncomfortable. The WSJ reported that Temu proved that U.S. consumers can afford long delivery periods when products are cheap. This is a scene from an ad that Temu, an ultra-cheap shopping mall in China, aired during the Super Bowl last year. It shows a user ordering a 9.99 dollar dress. Currently, Temu is known to suffer losses as it sells more. Each order is said to cost an average of 7 dollars.

The reason for such a loss is to secure a market share. Related industries predict that if Temu beats Amazon to become the No. 1 player in the U.S. e-commerce market, it will start monetization in earnest from then on. In other words, it will make up for its losses by abolishing benefits such as free shipping, increasing the average product unit price, and increasing the commission rate received from sellers. However, there are many skeptical views on whether Temu will be able to continue its growth as targeted. The biggest threat is sanctions imposed by U.S. politicians. If the so-called Short Form Exit Act, which passed the House of Representatives and was handed over to the Senate, is finally passed, the prevailing view is that Temu will be the next target.

SOPHIA KIM

US ASIA JOURNAL