Chinese e-commerce platform Temu is sweeping the Korean market. Temu’s weapons are ultra-cheap marketing and ultra-expensive advertising. Attention is also focusing on its parent company Pinduoduo (PDD) Holdings, which made it possible. Founded in 2022, Temu is an overseas version of Pinduoduo, one of China’s top three e-commerce companies. Pinduoduo, a subsidiary of Pinduoduo Holdings, started as a retail platform for agricultural products and has grown into a comprehensive platform that handles all products such as home appliances and cosmetics. Pinduoduo has more than 13 million sellers and more than 870 million active users in China. It accounts for a third of the nation’s parcel delivery volume and delivers tens of billions of packages annually.

Temu expanded its sales area to 49 countries in less than two years. It created a frenzy in the United States when it was determined to change the world’s shopping style with a platform that is faster, simpler, and cheaper than Amazon, an American e-commerce company.

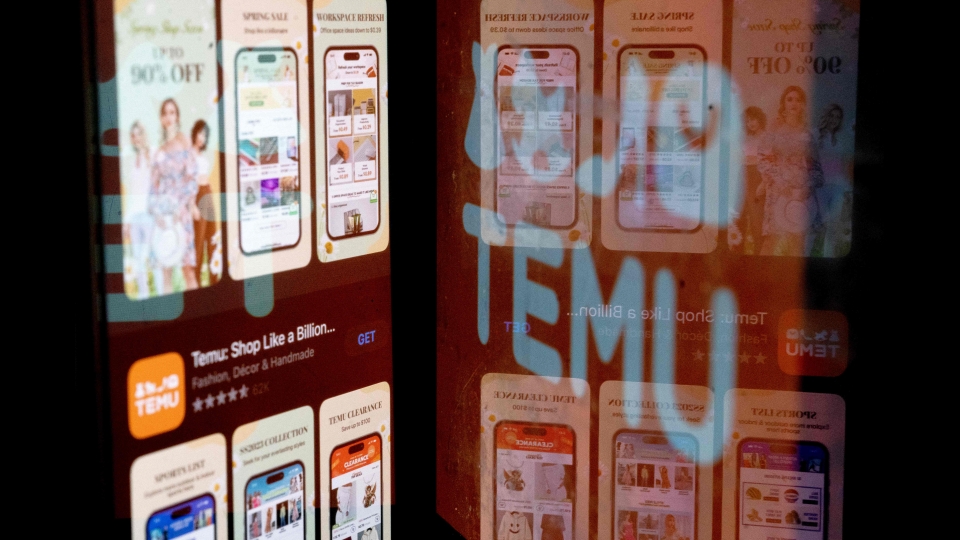

Temu also drew attention with its luxurious advertisements, such as placing an advertisement at the National Football League (NFL) final, which is famous for being expensive. Following last year’s event, the final of this year also claimed the most expensive billboards amounting to $6.5 million per second, and promoted the company to “shop like a billionaire.” Pinduoduo Holdings, the parent company, is a U.S. NASDAQ-listed company with a market capitalization of 155 billion dollars as of the 7th, alternating between Alibaba Group and the top market capitalization of Chinese companies in the New York Stock Exchange. Although the company is threatening Alibaba in terms of market capitalization and retail size, its employees and research expenditures are much smaller. As of early last year, Temu had 12,992 employees, which is only a few of Alibaba’s, and it is very small compared to Amazon’s 15 million employees. Citing this aspect, the Financial Times (FT) of the U.K. pointed out on the 6th (local time) that there is a mystery in the finance and management of Pinduoduo Holdings, which is in charge of Temu’s funding. Pinduoduo Holdings is a company worth 200 billion dollars, but it has only 150 million dollars in tangible assets. The company’s sales in the third quarter of last year almost doubled from the same period last year to $9.4 billion. It seems that it is investing a lot of money in the expansion of Temu, but it reported a cash flow of 2.5 billion dollars.However, the company has not disclosed the number or size of warehouses it rents, or the size of servers or call centers. Notably, the FT pointed out that it is not known how big the company has become because it has not disclosed its gross transaction value, one of the main indicators of e-commerce companies. According to Bloomberg, analysts estimated Panduo Holdings’ GMV last year at 3.6 trillion to 4.8 trillion yuan, with a consensus (average) of 3.9 trillion yuan. It also pointed out that the income statement and balance sheet indicators move at very different speeds.

Marketing service revenue in the third quarter of last year increased by about 40% year-on-year, showing almost the same pace of growth since mid-2021. In comparison, transaction fee revenue grew more than three times that of marketing service revenue during the same period.

In addition, co-founder and co-CEO Chen Lei Pinduoduo announced earlier that he would invest 10 billion yuan in “agricultural initiatives,” but it is unclear how the funds were spent or if they were spent, the FT said. At the time of the investment announcement, it did not disclose a clear purpose of the business and did not record in detail about the initiative’s spending in its financial statements. When asked about the initiative during a conference call to announce its 2022 earnings results, CEO Chen vaguely replied, “We are working with some of the best agricultural universities and research institutes to jointly carry out some research projects,” adding, “Investment in agriculture is in its early stages.” “Pinduoduo Holdings is a black box with its finances and its operations are shrouded in secrecy, but it is loved by Wall Street for its amazing growth,” FT said. “It is questionable why U.S. investors have so much confidence in its opaque operation, which seems to lack a lot of patterns or explanations in its financial statements.”

JENNIFER KIM

US ASIA JOURNAL