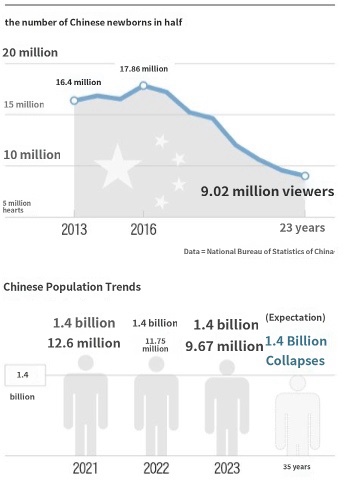

According to the National Bureau of Statistics of China, the number of newborns in China reached 9.02 million last year, half of the 17.86 million in 2016, and below 10 million for the second consecutive year. The China Market Research Group (CMR) predicts that the Chinese market for children’s products, services, and education, which is worth $500 billion annually, will shrink by 15 to 20 percent in the next five years. On the other hand, the size of the Chinese pet market, which is currently worth W100 trillion, is expected to grow, according to iMedia Research, a Chinese market research firm.

Pingxiang County, with a population of 320,000 in Xingtai City, Hebei Province, has been called a “Children’s Bicycle Holy Land.” More than 4,800 factories in the region produce 60 million bicycles, half of China’s total annual production. However, Pingxiang County, which visited on the 23rd, did not seem to have such a title. Many of the factories were in a quiet mood due to shorter operating hours, and some stores in the parts complex were closed and turned into foot massage shops. Over the past seven years, sales of children’s bicycles have plummeted as the number of newborns in China has halved, changing the landscape of the neighborhood.

On the other hand, Nanhegu, a city of 350,000 people that belongs to Xingtai and is 50 kilometers from Pingxiang County, was crowded. They wanted to buy food for dogs and cats at food stores concentrated in the region. With a decline in marriages and low birthrates, more people have pets like children, and more and more visitors to Nanhegu, known as the “home of pet food,” are also increasingly surging. Sixty percent of China’s total pet food is distributed here. Gross regional domestic product (GDP) increased from 7.7 billion yuan in 2019 to 9.54 billion yuan in 2022, an increase of nearly 20 percent in three years. This is because the number of Chinese pets has risen to an all-time high of 7.43 million yuan (as of 2022). One shopkeeper said, “It’s a wholesaler, and I had retail customers from all over the country, so I couldn’t take a break during the holidays.”

In China, not only bicycles for children but also baby-related industries themselves are rapidly shrinking. The top three baby formula companies saw their performance drop sharply. Sales of the largest company, China Payhe, fell 6.4 percent year-on-year in 2022, while Yassri fell 15.7 percent and Oostria Dairy dropped 9.1 percent. The Economist Intelligence Unit, a British economic think tank, predicted the size of the Chinese baby formula market to decline 32.3 percent from 173 billion yuan in 2021 to 117 billion yuan in 2025. Sales of the Hong Kong diaper brand Dodi in China also fell 12 percent year-on-year in 2022. Nestle shut down its milk powder production plant in Ireland in a statement in October last year, explaining the reason why “Chinese newborns are plummeting.”

The new affluent area in Xingtai, Hebei Province, is Nanhegu, the town of cats. The pet industry outlet located in the downtown of Nanhegu was crowded with two-story buildings. “Nanhegu dominated the emerging 産 industry,” said Wang Hong, an Internet influencer who was broadcasting live there. “There are more than 300 dog food brands in a small area.”

SOPHIA KIM

US ASIA JOURNAL