Currently, the U.S. benchmark interest rate ranges from 5.25% to 5.50%, the highest level in 22 years. In general, it is normal for the stock price, which is a typical risky asset, to go down if the interest rate is high.

However, the U.S. stock market has continued to rally. Following the S&P, the Dow is continuing its rally by renewing its foothold.

This is due to the special features of generative artificial intelligence (AI). On the 7th (local time), the New York Stock Exchange also staged an AI rally from Google.

In the New York Stock Exchange, the Dow rose 0.18%, the S&P 500 rose 0.80%, and the Nasdaq rose 1.37%, respectively.

When Google announced its own Generative AI “Geminai” the previous day, the stock price of Google’s parent company, Alphabet, surged more than 5%, leading the rally in the U.S. stock market. AMD, which produces AI-only chips, surged 10% as Google surged 5%, and its rival Nvidia also surged 2.40% as AMD surged 10%.

As a result, the Philadelphia Semiconductor Index, a group of semiconductors, also jumped 2.8 percent. As a result, the semiconductor index surged 48 percent this year.

Meta, the parent company of Facebook, not only related stocks but also large technology leaders, rose 2%, Amazon rose 1.6%, and Apple rose 1%, respectively.

Despite high interest rates, the U.S. stock market is rallying due to favorable AI.

So how long will the AI rally last? Experts say the AI rally will continue for a while.

This is because AI is a big ‘game changer’ that is compared to the launch of the Internet and the advent of Apple’s iPhone. Therefore, almost all big tech companies are putting their lives and efforts into AI to take the lead.

According to a recent report by the New York Times (NYT), big tech companies are investing billions of dollars into Generative AI, a ChatGPT-based technology.

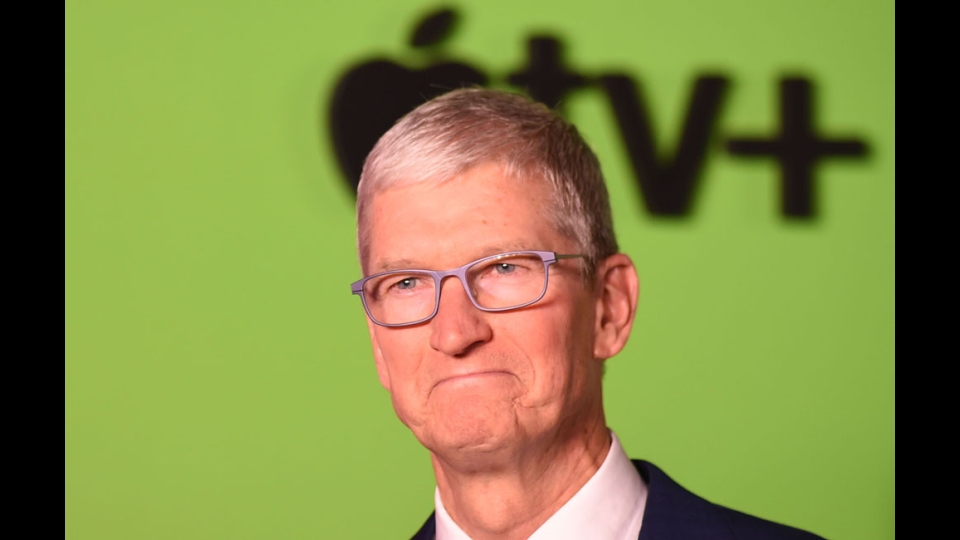

Starting with Microsoft (MS), Google, Meta, Amazon, and Apple are also increasing their investment in AI.

Apple CEO Tim Cook said in a conference call after the recent earnings announcement, “AI is an essential and key technology for all products we develop,” adding, “We increased R&D costs by $3.1 billion last quarter from last year.” Stacey Lasgon, an analyst at securities firm Bernstein, said, “The recent AI investment reminds us of server investment in the late 1990s and data center investment in the 2010s. The AI craze will continue for a while.”

JULIE KIM

US ASIA JOURNAL