Chairman Kim Bum-soo, chairman of the board of directors, a Financial Supervisory Service, was investigated for 15 hours of Kakao’s SM Entertainment Co., Ltd.

Former chairman Kim, who attended 10 p.m. on the 24th.

Former chairman Kim said, “We certainly took a survey on the investigation of Yeouido Financial Supervisory Service, saying, “The entrance of Kakao Stock Exchange” without any answers.

The Financial Supervisory Service market special judicial police are known to focus on whether Kim Jeon-soo was directly instructed or reporting whether Chairman Kim was directly reported or reported.

The Kookmin messenger Kakao was the biggest crisis since Changsa Temple was Changsa Temple.The problem of ” moral hazard” which is represented by management staff and corporate card useful controversy over corporate cards and corporate card useful controversy over corporate card useful.The warning of securities firms that need to significantly significant in judicial risk, saying that the future initiative Kim Bum-soo’s future initiative Kim Bum-soo, the Financial Supervisory Service.

The reason why the start-ups were posted on the Financial Supervisory Service’s photo line of SM Entertainment.The Financial Supervisory Service (special investigation) is suspected that Kakao executives, Kakao executives, are suspected that Kakao executives have attracted more than 24 billion won in February.The key issue is involved in the stock price manipulation of Kim Center.The special envoy was known to have been reported to be reported or instructions on the rise in relation to the rise or instructions.Is there any intentionality and destination of hybrid SM Enterprise.In this process, it is also looking at the circumstances of private equity fund operator, known as Kakao side of Kakao Partners, known as Kakao side.ON Asia Partners had the same registration address of SM Entertainment Securities Co., Ltd. on February 16, with the same registration address of IBK Investment Securities Co., Ltd. on February 16.9 percent.It was a period of time to buy SM Entertainment shares at 12 million won per week.As stock prices jumped 13 million won, hybrid, hybrid has failed to open sales, and the management rights of management rights.The special envoy is also looking at the possibility that Kakao and Won Asia Partners, and Won Asia Partners, and the Korea Investment Association is also looking at the possibility of the stock price holder.In the Capital Markets Act, which owns or special officials owned by the Capital Markets Act shall report within five business days, it should be reported within five business days.

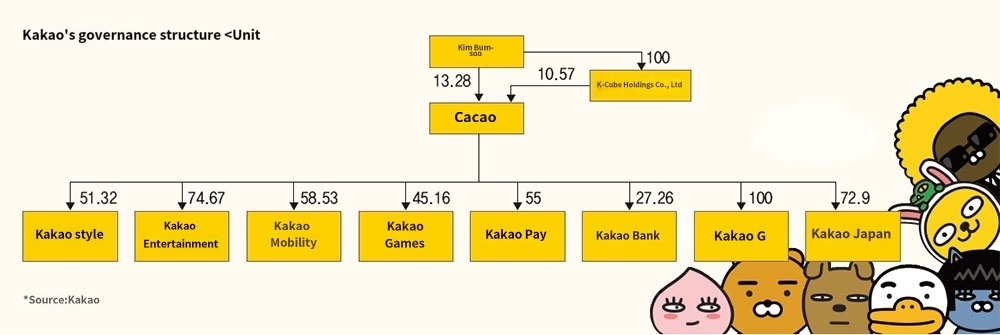

There are many analysts say that Kakao’s “the-art growth” is not a lot of analysis.Kakao, who was evaluated as “hyuk’s icon,” which was evaluated as “hyuk’s icon” and 14 affiliated.It was big, but there was no doubt.The affiliated responsibility management of autonomous responsibility management.In the meantime, internal control has become loose and the controversy over management’s moral hazard.Before Ryu Young-joon, former CEO Ryu Young-joon, who had the mound in order to resign and solve controversy over the controversy over the controversy over the controversy over the controversy.Some point out that the repeated moral hazard of management staff, it is pointed out that the judicial risk of management team has raised this judicial risk.Right now, judicial risk has emerged as a major affiliated issue of Kakao Bank, a major affiliated issue.If the worst case is confirmed to be true, Kakao may lose the status of major shareholders’ status.If financial authorities are ordered more than 10% of Kakao Bank, there is a risk of change in the group of Kakao Bank, there is a risk of change.In the future, it is inevitable to determine the decision-related doctors.Kakao Entertainment and Kakao Mobility Business disclosure (IPO) is likely to be postponed.The goal of Kakao Entertainment and SM Entertainment, the target of overseas sales in the global entertainment market was unclear to 30% to 30% by 2025.

Kakao is considering the reorganization of the management system from last month.This is aimed at changing autonomous management limits and acquisition group (M&A) and acquisition group (M&A) to supplement the final decision to completion of autonomous management limits.Kakao official said, “It is a large company’s reorganization is large and small company,” said, “We are discussing in relation to the investigation of Kim startups.”On the 27th, the Ministry of Trade, Industry and Energy decided to attend a comprehensive state audit on the 27th, Hong Eun-taek, said on the 27th.Initially, Kim Center was applied as a witness, but the FSS investigation, but the FSS investigation was determined as Hong representative Hong representative of the FSS investigation.KakaoVX and Kakao Mobility is suspected that he took the technology of startups, Kakao Healthcare, Kakao Healthcare, Kakao Healthcare, Kakao Healthcare, and Kakao Mobility, Kakao Mobility, Kakao Mobility, Kakao Mobility.

Smartco announced that KakaoVX has filed a lawsuit on February, saying that KakaoVX was copied by KakaoVX, and defeated KakaoVX.However, KakaoVX employees are currently investigated by March 2021.

In addition, the worst scenario is to lose the qualification of Kakao Bank, according to the results of the investigation results.Earlier, Kakao Bank purchased 16% stake in Kakao Bank purchased 16 percent stake in Kakao Bank from Korea Investment Financial Group, and rose to the largest shareholder with a total of 34%.This was a case where industrial capital (non Financial State) was born in Korea, which is the first week, was born in Korea.

According to the Internet expert Bank Act, the number of major major economic crimes, tax punishment law, tax punishment law, tax punishment law, tax criminal punishment law, tax criminal punishment law, etc.If Kakao’s application related disposition related disposition related disposition of Kakao Bank, it is that it is directly affected by Kakao Bank’s shareholder rights.

In the industry, Kakao expects Kakao will enter an emergency management system soon.

An industry official said, “If Kakao is a community autonomous management system, the impact on management, the impact on management, it will be limited to investment as well as investors.”

SOPHIA KIM

US ASIA JOURNAL