Forget city traffic and the shortage of parking spaces in shopping areas. More South Koreans are shopping on overseas e-commerce sites, with products ranging from simple fashion items to appliances.

The so-called “jikgu-jok” — a tribe of shoppers buying goods directly on foreign websites — is growing rapidly here, as more people seek to dodge local retailers’ high markups on imported goods and have a wider range of choice.

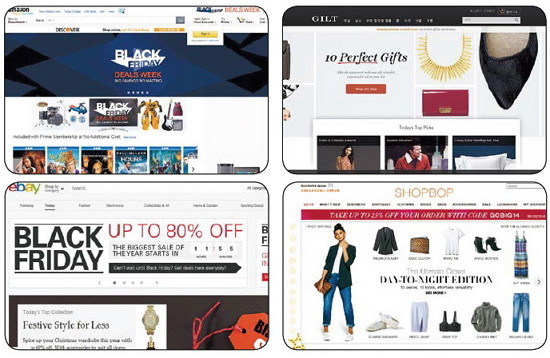

Jikgu-jok calls themselves “smart consumers.” They claim they pay less for the same products by logging on to the sites of U.S. shopping malls.

Choi Yoon-jeong, 32, the mother of a 3-year-old, joined the bargain hunting five years ago when e-commerce sites connecting domestic buyers to direct online shopping were fairly rare.

She buys her son’s Ralph Lauren Tshirts and J-Crew jackets at cheaper prices than local brands’. Last year, she bought a Maclaren’s Quest baby stroller for only $270 with free shipping, when it was being sold for 410,000 won ($371.60) in local department stores.

“I noticed that consumers end up paying more because of distribution costs, taxes, and customs and shipping fees. I can cut through all that because I’m buying directly,” Choi said.

With the broader access to e-commerce platforms, more people have joined the movement, including housewives, students and office workers.

Last year, South Korean consumers bought $1.04 billion worth of goods from online retailers based abroad, marking the first time they have hit the $1 billion sales mark, according to Statistics Korea.

The figure is a whopping 380 percent increase from 2010’s $274 million. Market insiders believe the number will surpass the $2 billion mark this year following Black Friday and Cyber Monday’s shopping season.

Malltail.com, the biggest and most popular direct-purchasing site, said it saw a 13-fold revenue jump at 26 million won from 2010-2013, while revenues at local department stores and online shopping malls fell for four consecutive sales seasons this year.

Popular shopping items vary in size, but clothing and shoes account for the main share, standing at 27 percent, according to Statistics Korea.

Vitamins were the next most-popular item at 14 percent, followed by cosmetics and designer bags, both at 8 percent, and children’s toys at 3 percent.

“In the past, there was less interest in direct buying overseas due to complications such as language barriers at foreign websites and payment options. But now, people can easily buy from foreign retailers via KakaoStory (a social network service similar to Facebook),” said Lee Ki-won, a marketing manager at Hyundai Home Shopping.

“Even people who aren’t Internet-savvy have a better chance of finding exclusive deals abroad and getting them delivered to their home in less than a week,” he said.

Market watchers believe the retail industry is being reshaped by such changes in consumer behavior.

Aside from the development of the Internet and reasonable pricing, experts point out that the trend has been further fueled by a string of government eregulations made to revitalize the domestic economy.

Earlier this year, the country’s customs service simplified the importation procedure and doubled the maximum value of products that can be imported tax-free from the U.S. to $200. For other countries, the limit is $100.

Considering that the average value of a single shipment last year was $93, the majority of consumers were saving on taxes and distribution costs.

Countering this trend, there has been a movement by department stores and import brands to launch promotions, along with an increased emphasis on e-commerce.

Last week, an advertisement by a major department store read “Cheaper than jikgu (direct buying overseas).” The brand on sale sold imported children’s products.

“Consumers these days have become smarter, savvier and thriftier,” said Kim Si-wol, a professor at Konkuk University’s consumer information department.

“The shift in consumer buying habits will not just end as a boom. It will encroach on the domestic retailers as well as bricks-and-mortar (stores).”

By Suk Gee-hyun (monicasuk@heraldcorp.com)