The nation’s households have rapidly increased their borrowing from commercial banks amid the record-low interest rates and brisk property transactions, data showed Monday.

The Financial Supervisory Service said Monday that the banks’ (won-denominated) outstanding loans to the household sector reached 526.1 trillion won ($487.1 billion) at the end of March, up 4 trillion won from a month earlier.

This increase marked the highest growth in nine years ― for March every year ― since the FSS started to compile official statistics on the banking sector’s collective household lending in 2006.

The regulatory agency attributed the drastic growth to increase in purchase of apartments taking advantage of the benchmark interest rate, which was lowered by 25 basis points to 1.75 percent on March 12.

Trading volume of apartments in Seoul came to 13,100 units in March, far exceeding 8600 units in February.

An FSS official said another possible factor could be that a large number of borrowers might be using their low-interest bank loans for investment in risky assets like stocks.

While the stock market’s daily upper and lower circuit breakers are scheduled to be expanded to 30 percent starting in June from the current 14 percent, market insiders say that the widening disparity between risky assets and bank deposit rates could be both a boon and bane for households.

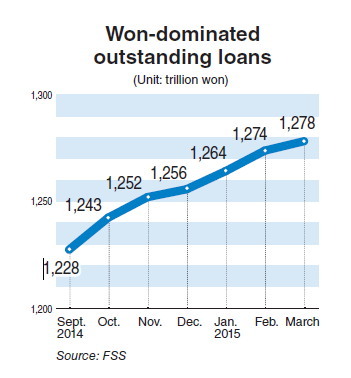

Buoyed by the consumer loan growth, the banking sector’s totaling outstanding loans to both the corporate and household sectors increased by 0.4 percent, or 4.6 trillion won, from the previous month to 1.27 quadrillion won in March.

While their lending to small- and medium-sized enterprises climbed by 5.8 trillion won to post 537.5 trillion won, loans to the conglomerates fell by 4.2 trillion won to 183.3 trillion won.

Authorities and private analysts shared the view that household loans from the secondary financial firms and loans sharks at high interest rates ― over 20 percent ― is a matter of serious concern.

South Korea saw the ratio of households’ debt to disposable income hover around 160 percent at the end of 2013, higher than the average of 134 percent in the 34-member Organization for Economic Cooperation and Development.

By Kim Yon-se (kys@heraldcorp.com)