International property buyers, many of whom left Korea after the global financial crisis in 2008, are returning to Seoul in search of bargains on commercial office buildings, market sources said Friday.

Morgan Stanley, a global investment bank, is just one investor that will reopen its real estate investment fund in Korea. The investment bank closed its property business in Korea in 2010 when it posted a significant loss from its $1 billion investment in the Seoul Square office building located across from Seoul Station.

The return of Morgan Stanley’s property investment business is in line with a positive outlook for the local office market.

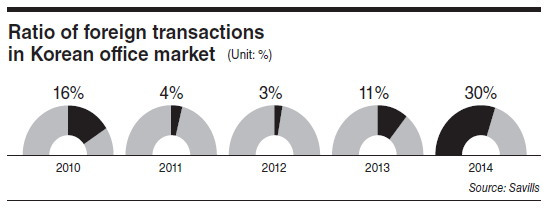

A recent report by Savills, a U.K.-based real estate services provider, showed foreign transactions in the Korean office market rose to a five-year high of 30 percent in 2014, which was an almost threefold increase from 11 percent in 2013.

Savills’s data shows a recovery trend from 2012, when it fell to 3 percent.

“Foreign institutional buyers favor investing in Korean office buildings so that they can reap around 6 percent annual yields from their property investments in a stable manner,” said Son Hyo-sang, spokesperson for Savills Korea.

Korea is ahead of other Asian cities in its yields from office building investments in 2014, with yields in Tokyo and Shanghai around 4 percent and 4.7 percent, respectively.

Savills forecasts foreign transactions in the local office market will continue to rise for some time, boosted by global liquidity expansion amid a low interest rate environment.

Another trend for foreign property transactions is an increasing influence of property funds from the Middle East, which was once dominated by U.S. and European institutional investors.

Abu Dhabi Investment Authority, one of the three largest sovereign funds in the world, purchased the State Tower Namsan building for 500 billion won ($485.7 million), the largest deal in the local office market in 2014.

Meanwhile, Chinese investors appear cautious of Korea’s office market.

“Activities by Chinese investors in the Seoul office market remain relatively low as they still prefer residential properties to office buildings,” Son said.

By Seo Jee-yeon (jyseo@heraldcorp.com)