As the possibility of the U.S. tightening regulations on China increases ahead of the presidential election, China is also preparing for a trade war by using various means. Some predict that China will use export controls of its mineral resources in the global supply chain as a weapon or attack certain companies intensively.

A high-ranking business official expressed concern on the 8th, saying, “For South Korea, it is an opportunity to widen the technology gap with China, but as a result, uncertainties such as China’s retaliation, restrictions on access to the Chinese market, and stimulation of China’s own technology development also increase.”

Earlier this month, Bloomberg reported that a high-ranking official of the Chinese government threatened Japan with a strong level of economic retaliation if it actively participates in the U.S. semiconductor export control. The U.S. is demanding Japanese semiconductor equipment company Tokyo Electron and others to participate in the export control to China. If Japan accepts the request and restricts the export of Japanese semiconductor equipment to China, China will block its mineral exports to deal a blow to the Japanese finished car industry including Toyota. Toyota is also an investment firm of Lapidus, a semiconductor company established by Japan to revive semiconductors.

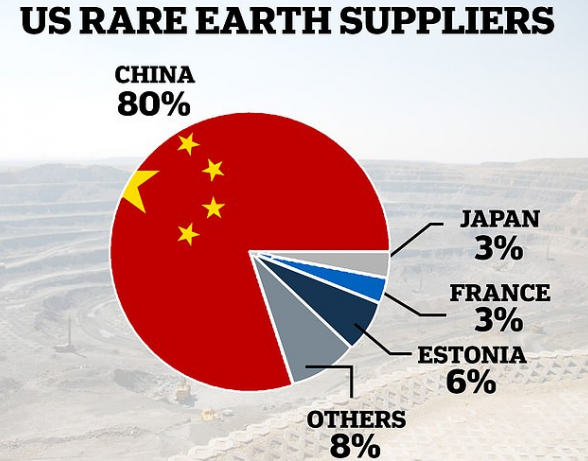

Japan is also known to be agonizing over China’s possible recurrence of the nightmare of halting exports of rare earths in 2010. At the time, China temporarily suspended exports of rare earths, a key mineral in the electronics industry, amid territorial dispute between Japan and the Senkaku Islands, shaking the entire Japanese manufacturing industry.

Critics point out that South Korea is also vulnerable to China’s retaliation for “weaponizing resources” as it is highly dependent on key minerals for China. An official from the semiconductor industry said, “We have been investing a lot in the U.S. since the Biden administration, but at the same time, we need to prepare for concerns about China’s economic retaliation because we are highly dependent on China.”

As the U.S. tightens its regulations on semiconductors with China, China’s own rise is also a long-term threat to the Korean semiconductor industry. The number of cases of semiconductor development by Chinese companies, which have already received huge subsidies from the Chinese government, has increased significantly. Last month, foreign media such as the Wall Street Journal (WSJ) reported that Huawei is about to mass-produce the latest artificial intelligence (AI) semiconductor, “Ascend910C,” causing a stir in the semiconductor industry. It developed its own AI semiconductor about two years after the U.S. government’s export control to China began in October 2022 and Nvidia’s supply of advanced chips was blocked. “One of the biggest concerns as U.S. regulations cut off exchanges with the Chinese market is that it has become a ‘blind’ to see what level of development is taking place in China,” said another Korean semiconductor industry official. In the long run, there is also a possibility that China will jump into the high value-added memory market, which is led by South Korean companies such as Samsung Electronics and SK Hynix, in the global AI market.

China’s rapid economic slowdown and China’s entry into a recession due to China’s regulations could also pose a headache for the Korean economy. Due to the long-term economic slowdown, China’s inventory ratio of finished products has risen from 1.68 percent in November last year to 4.67 percent as of June this year. Increasing inventory of finished products leads to a “push-out low-cost offensive.” “If the U.S. tightens tariffs on China and China’s domestic market does not recover, chances are high that China will continue its offensive on other markets (such as Korea),” a KCCI official said.

SALLY LEE

US ASIA JOURNAL