In September, the dollar hit its lowest level this year due to a shift in funds that weighed on the possibility of a U.S. rate cut. On the contrary, the Japanese yen has turned strong in anticipation of a rate hike, and the carry trade, in which the Japanese yen borrows low-interest national currencies to invest in high-interest national currencies or stocks, is also facing an inflection point. A new carry trade is also being witnessed, in which the Japanese currency sells the dollar and invests in currencies of emerging economies such as Brazil’s Real, Turkiye and Lira, breaking away from its investment strategy centered on the “en carry trade.”

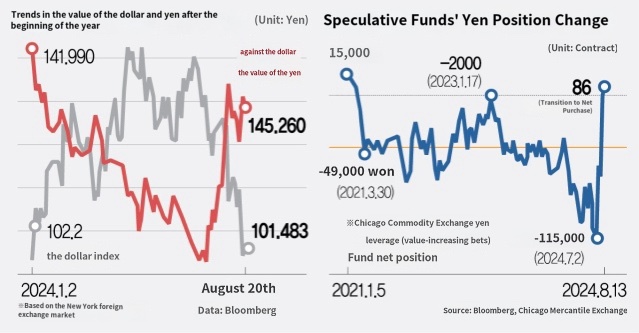

According to Bloomberg News and the Nihon Keizai Shimbun on the 21st, the dollar index, which shows the value of the U.S. dollar against the currencies of the six major countries, fell below 101.40 at one point on the day, the lowest level this year. Analysts say that the move to move funds to emerging currencies with higher interest rates is lowering the dollar’s value as the U.S. Federal Reserve is expected to cut interest rates in September on various economic indicators such as inflation and employment. According to the Chicago Mercantile Exchange (CME) FedWatch Tool, the federal funds rate futures market sees a 100% chance of a rate cut in September. The dollar’s weakness is in full swing as major U.S. stock indexes have recovered most of their losses after plunging after the U.S. employment report and concerns over a recession earlier this month. “The market is expecting a soft landing and the Fed’s rate cut,” Atanasios Bambakidis, head of foreign exchange strategy at Bank of America, said. “This is negative for the dollar.”

On the contrary, the Japanese yen is strengthening as expectations for an additional interest rate hike spread. The yen, which fell to 161.94 yen per dollar at the beginning of last month, is currently trading in the 144-145 yen range. The yen’s value rose more than 7% against the dollar last month due to the Bank of Japan’s additional rate hike, the possibility of a U.S. rate cut, and the liquidation of the yen carry trade due to the narrowing of the interest rate gap between the two countries.

As the yen, which has long been a relatively low-priced currency, has been adjusted in value, the fund is also moving to a currency that can yield higher profits. U.S. Citigroup pointed out that hedge funds are spending (selling) dollars for the New Carry trade. They say that the U.S. dollar, which was an object of interest, has turned into a low-interest rate currency that they borrow to buy other assets. “The prospect of a U.S. rate cut has stimulated risk preference,” said Christian Kasichov, global head of Citigroup FX Investment. Hedge funds using the carry trade strategy are choosing the dollar as their financing currency rather than the yen. Hedge funds have been buying emerging market currencies such as Brazil’s Real and Turkiye’s Lira with funds that have been raised by borrowing dollars since May 5. “The Brazilian Real has been weak for nearly a year, but its policy rate has been highlighted at 10.5 percent, which is gaining popularity,” Kasichov said. “The inflow of funds tripled last week.” Bloomberg said, “The currency of emerging economies is highly volatile, so the risk is higher than that of advanced economies,” adding, “The recent flow of funds can also be seen as a ‘dollar carry trade’ of selling dollars and buying currencies of emerging economies, and market participants are willing to take risks.”

However, there are many cautious opinions that it should be seen whether the dollar will weaken and the new carry trade will continue. As the current risk preference is based on the premise that “the U.S. economy will not fall into a recession even if it slows down,” the situation may vary depending on future economic indicators. Fed Chairman Jerome Powell’s Jackson Hole speech on the 23rd is also closely watched by investors as clues regarding interest rates can be presented.

SOPHIA KIM

US ASIA JOURNAL