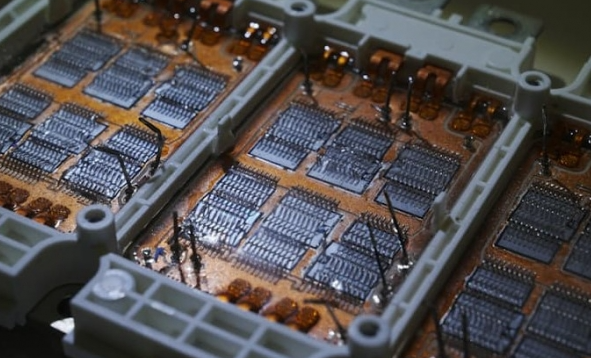

Semiconductor companies that are dreaming of revival are actively investing in facilities with the support of the Japanese government. Japanese semiconductor companies are increasing their investments in power semiconductors, sensors and non-memory (logic) fields, which are the basis of future national industrial competitiveness such as artificial intelligence (AI), decarbonization, and electric vehicles (EV).

Semiconductor companies such as Sony, Mitsubishi Electric, ROM, Toshiba, Kioxia Holdings, Renesas Electronics, Lapidus, and Fuji Electric surveyed their facility investment plans for nine years from 2021 to 2029 worth 5 trillion yen.

Sony Group will invest about 1.6 trillion yen from 2021 to 2026 to increase production of semiconductor image sensors. It also planned to build a new plant in Kumamoto Prefecture after increasing its production plant in Nagasaki Prefecture last year. In addition to smartphone cameras, the image center, one of Sony’s competitive advantages, is expanding its demand for autonomous driving.

Investments in power semiconductors, which efficiently control power, are also continuing to target the expansion of markets such as data centers for artificial intelligence and electric vehicles. Toshiba and ROM will invest about 380 billion yen in this field. Mitsubishi Electric plans to more than five times its power semiconductor production by 2026, including the construction of a new plant in Kumamoto Prefecture at a cost of about 100 billion yen.

In the non-memory field, Lapidus, which was created by eight large companies, including Toyota and NTT, is aiming to produce 2 nanos, the semiconductor of its dreams. It started construction of the plant in Chitose, Hokkaido in September last year, and plans to mass-produce it in earnest by 2027 following test production in 2025.

Japan was an “absolute powerhouse” in the semiconductor market, with a global market share of 50% from the 1980s to the early 1990s, but its market share fell below 10% in 2017 due to Korea and Taiwan. As semiconductors grow in importance in the process of restructuring supply chains that began in 2020 due to the U.S.-China confrontation, the Japanese government is taking advantage of this opportunity to make a large-scale financial investment in the hope of reviving semiconductors.

SOPHIA KIM

US ASIA JOURNAL