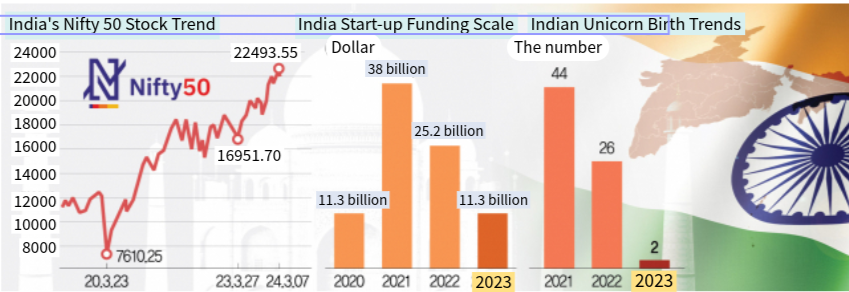

The stock market has continued to rise to record highs every day, and companies that are about to make an initial public offering (IPO) are also recording the largest ever, but venture capital (VC) funds, which are actually growing, are drying up. Behind optimism about India’s economy, there are also critical views that start-ups’ valuation is a bubble. On the 19th, the Nihon Keizai Shimbun quoted data from global accounting firm EY and predicted that IPOs on the Indian stock market will be the largest ever this year. Last year, IPOs on India’s two largest exchanges, the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), rose 48% year-on-year to 220 cases, the highest in the world. The two exchanges raised $6.9 billion in IPOs over the past year, surpassing the Hong Kong Stock Exchange (5.6 billion dollars). Nikkei predicted that 75 IPOs are scheduled in the first quarter of this year, which will increase the size from the previous year. The IPO boom is deeply related to the Indian stock market, which has been at an all-time high every day. The Nifty 50 index, which consists of the top 50 companies in market capitalization listed on the NSE, has rousing investors, rising by 30% over the past year and more than 190% over the past four years. Amid such an atmosphere, a growing number of unlisted companies are seeking to secure funds for their growth through IPOs. Optimism for growth continued with GDP growth at 8.4 percent in the fourth quarter of last year, and overseas funds are being diverted to India instead of China due to the U.S.-China conflict. Expectations are also raised that an IPO of India’s largest electric two-wheeled vehicle maker, Ola Electric, which is expected to be recognized as worth up to 8 billion dollars, is on the way. Unlike the IPO market, however, investments in VC that grows the startup ecosystem are rapidly drying up. According to the Financial Times, the Indian market was particularly hard hit amid the global VC market’s contraction last year. The figure represents a sharp drop of 60 percent from 26 billion dollars in 2022 to 9.5 billion dollars last year. The number of transactions has also sharply decreased from 1,611 to 880. According to Indian economic media Entracker, the annual funding amount that its startups received fell by one-third from 38 billion dollars in 2021 to 11.3 billion dollars last year. The fact that only two unicorns (unlisted companies with an enterprise value of more than 740 million) were produced last year, which was 44 in 2021 and 26 in 2022, is also interpreted as a warning. FT analyzed that the aftereffects of the bubble that global big players made huge investments with optimistic prospects for India and withdrew with great losses are continuing. For example, “Buyjuice,” an edutech company called “Indian Megastudy,” was once recognized for its corporate value of $22 billion, but is now valued at less than $1 billion. Ashish Gupta, chief investment officer (CIO) of Indian asset management firm Axis Mutual Fund, said, “The valuation of private equity funds was delusional,” adding, “Adjustments will take place.” Another source of concern is that India’s benchmark interest rate has increased from 4% in 2022 to 6.5% last year. “Investors’ attention to startups has become stricter due to changes in the global financing environment, such as financial tightening,” Nikkei said. “In order for India to continue to be chosen by investors, it will have to meet the two tasks of innovation and securing profitability.”

EJ SONG

US ASIA JOURNAL