Japan’s Nikkei index did not receive much attention due to news that it hit an all-time high in 34 years, but there are other Asian stock markets besides Japan that are breaking daily highs. It is Taiwan. Taiwan’s par value index on Monday continued its upward trend, once exceeding 19,000 and approaching the all-time high of 19,023.01, which was recorded on Sunday. TSMC, Nvidia’s AI chip maker, is credited with the rise as the top contributor. TSMC rose more than 30 percent since October last year and closed at only 698 Taiwan dollars on Wednesday. As Nvidia’s market capitalization surged to surpass 2 trillion dollars, TSMC has continued to rise day after day. Thanks to the artificial intelligence craze, Taiwan’s listed companies, whose population (23.42 million) is less than half that of Korea’s, have also surpassed Korea’s. Let’s take a look at the Taiwanese stock market.

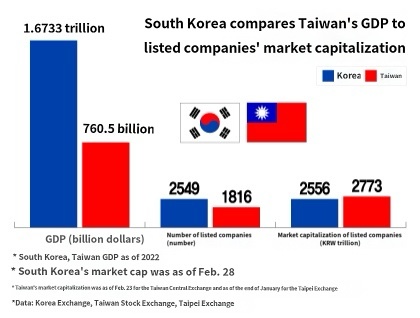

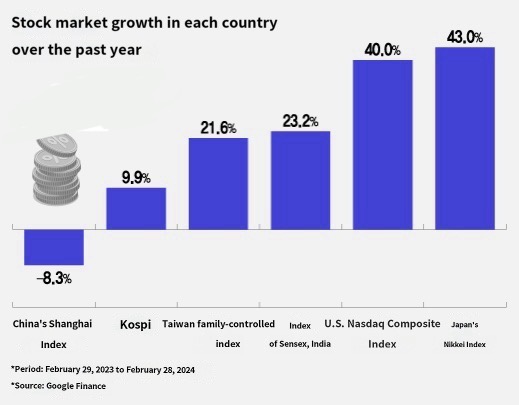

Over the past year, Taiwan’s market capitalization index rose 21.6 percent due to the AI boom. Although it is less than 43 percent of Japan’s Nikkei 225 and 40 percent of the U.S. Nasdaq, the rate of increase is relatively high. During the same period, Korea’s KOSPI index rose only 9.9 percent, while China’s Shanghai Composite Index fell 8.3 percent. What should be seen more carefully than the index’s rise is that the market capitalization of Taiwan-listed companies has exceeded that of Korea. Taiwan has less than half of its population and gross domestic product. As of 2022, Taiwan’s GDP is 760.5 billion dollars, which is only 45 percent of Korea’s (1.6733 trillion dollars). However, as the Taiwan’s market capitalization has continued to surge recently, the market capitalization of Taiwan-listed companies has reached 2773 trillion won, surpassing that of Korea (2556 trillion won). This is thanks to Taiwanese semiconductor companies represented by TSMC. TSMC’s influence in the Taiwanese stock market is huge. It is more than Samsung Electronics’ presence in the KOSPI stock market. TSMC’s market capitalization accounts for about 30 percent of the total market capitalization of the Taiwan Stock Exchange. The Taiwan Stock Exchange consists of the Taiwan Stock Exchange (TWSE), where companies with high market capitalization are listed, and the Taipei Exchange (TEX), which is similar to the KOSDAQ market. TSMC’s facility investment (CAPEX) to expand semiconductor production capacity directly affects the performance of Taiwanese semiconductor companies. TSMC’s facility investment reached an all-time high of $36.3 billion in 2022, but it fell 16.1% to $30.5 billion last year due to slowing semiconductor business. TSMC plans to invest $28 billion to $32 billion in facility investment this year.

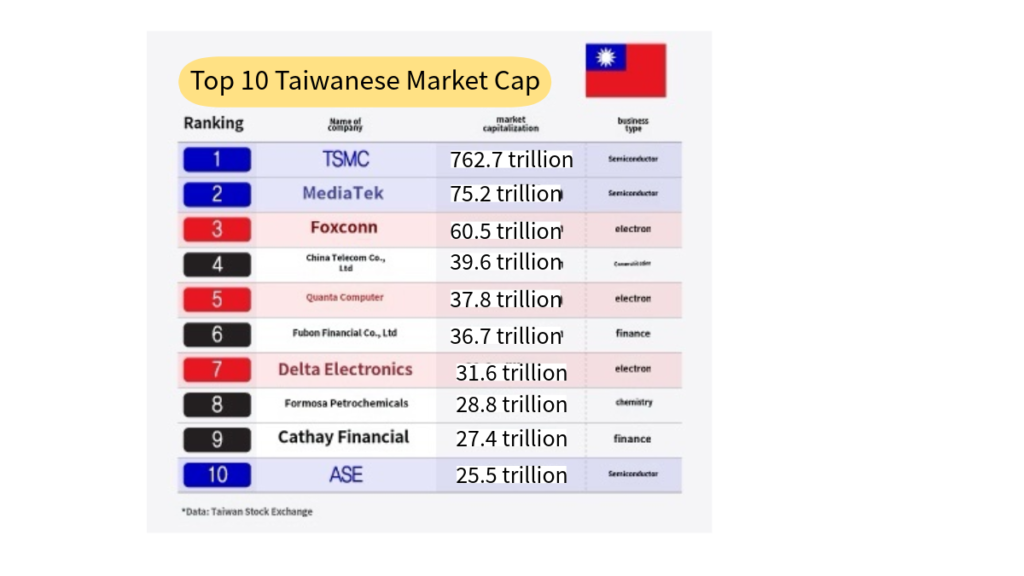

Let’s take a look at the top 10 companies by market capitalization in Taiwan. TSMC, the world’s No. 1 foundry production company, saw its market capitalization reach 763 trillion won (approx. TSMC has led Taiwan’s stock market with its stock price nearly quadrupling since 2017, and as Nvidia’s market capitalization has risen to nearly 2 trillion dollars, it has recently hit a new all-time high. Most of Nvidia’s AI chips are produced by TSMC. Nvidia’s CEO Jensen Huang and AMD’s CEO Lisa Su are both Taiwanese and American, which is why they worked in Taiwan’s favor. Nvidia and AMD are the world’s No. 1 and No. 4 fabless (semiconductor design) companies. In particular, Jensen Huang is working hard on TSMC to the extent that he visited Taiwan and congratulated TSMC in person when he won the first Li Guo-ding Award in November last year to commemorate former Finance Minister Li Guo-ding, the father of Taiwan’s economy. He is so affectionate that he often says, “Without TSMC, there would be no Nvidia.” When Jensen Huang sent an e-mail to Morris Chang in 1995, the third year of Nvidia’s founding, to inquire about consignment production of semiconductors, Morris Chang called him in person to start the collaboration between the two companies. MediaTek, a fabless company, has the second-largest market capitalization in Taiwan, with a market capitalization of 75 trillion won (approx. It accounts for only 10 percent of TSMC’s market capitalization, but MediaTek is also an important chipmaker. According to market research firm Counterpoint Research, MediaTek ranked first in the global mobile application processor (AP) market with a 33 percent market share in the third quarter of last year (by shipment). Next came Qualcomm (28 percent), Apple (18 percent), Unisok (13 percent), and Samsung (5 percent). Foxconn, the third-largest supplier of Apple, is not a semiconductor company, but it is also the world’s largest computer ODM (manufacturer design and production) company that commissions Apple MacBook. Taiwan has developed not only chipmakers but also electronics commissioned producers. Delta Electronics is an electronics manufacturer that produces power supplies for industrial use and computers. ASE, the world’s No. 1 post-processor (OSAT) company, ranked 10th with a market capitalization of 25.5 trillion won (approx. ASE announced this month that it would acquire German chipmaker Infineon’s semiconductor packaging plant in Cheonan, increasing its influence in Korea.

Six of the top 10 companies in the market capitalization are semiconductors and electronics industries

The top 10 companies in Taiwan’s market capitalization include semiconductor companies such as TSMC (No. 1), MediaTek (No. 2), and ASE (No. 10). Including electronics companies that are highly related to semiconductors such as Foxconn (No. 3), Quanta Computer (No. 5), and Delta (No. 7), six are in the semiconductor and electronics industries.

The remaining four companies were China Telecom (4th, telecommunications), Fubon Financial (6th, finance), Formosa Petrochemical (8th, chemistry), and Cathay Financial (9th, finance), with telecommunications (1), finance (2), and chemistry (1).

SOPHIA KIM

US ASIA JOURNAL