China is strengthening its position in the U.S. market. Some say that Temu and Xuin can grow into platforms that go beyond Amazon. On the other hand, some say that it will be difficult to maintain business in the long term due to aggressive pricing policies. How will Chinese companies end up.

The main reason they targeted the U.S. is to take advantage of ‘tariff-free’. The decision was aimed at loopholes in the U.S. customs policy. Under the current U.S. Customs Act, tariffs are not imposed on imports under $800 (about 1.05 million won). Until 2015, the tariff-free standard was around $200 but in March 2016, this standard was expanded to $800 to revitalize e-commerce.

At that time, there was an opinion in Korea that Korean companies would benefit, but Chinese companies are actually receiving the benefits. According to a special committee report on China released by the U.S. House of Representatives in June, 30% of small packages entering the U.S. were shipped from Xuin and Temu.

China’s Alibaba Group’s overseas direct purchase platform “Ali Express” and social media platform TikTok’s e-commerce platform “TikTok Shop” are also expanding their global influence. AliExpress is gaining popularity not only in the U.S., but also in Korea, Brazil, Spain, and France, and has established itself as an “Overseas Direct Purchase App” in the global market.

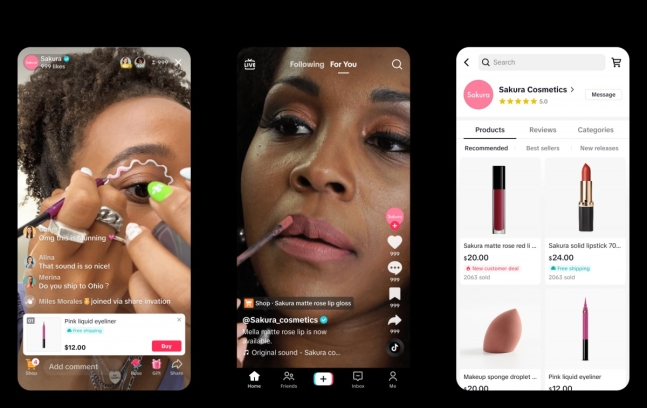

Among these four companies, TikTok Shop is the latest to head to the U.S. Since November last year, TikTok has conducted a beta test of its e-commerce service “TikTok Shop,” which was officially launched in the U.S. in September this year.

TikTok’s strength is that it has 150 million MAUs. Compared to 2020, when there were around 100 million people, this is a 50% increase, which means that one in three Americans use TikTok.

The initial response is positive. According to data analysis company Jungle Scouts, 68% of Gen Z in the U.S. are willing to buy it from TikTok shops. On a total user basis, 49% said they would use the service.

Local attention is also keen. “TikTok Shop has finally arrived in the U.S.,” IT media TechCrunch said. “We have secured 200,000 sellers and recruited more than 100,000 creators right after its launch.” The New York Times reported that more than 90 percent of TikTok shop sellers are based in the U.S. The Financial Times said that TikTok Shop is a new challenger to Xuin and Amazon. Chinese companies, which have made full use of tariff-free policies under 800 U.S. dollars, are engulfing the global e-commerce market, mainly in the U.S.

“China has been a major exporter of various consumer goods for a long time, and recently it is shaking up the global e-commerce market,” British fashion magazine BoF said. “Chinese companies such as Temu and TikTok shops are growing rapidly in Southeast Asia, North America, and Europe. As the country began to dominate Western regions, it sparked a “cost-effectiveness war.”

In the process, the landscape of the shopping market is changing. “In the past, global e-commerce platforms focused on selling high-margin items to increase profitability,” BoF said. “With the emergence of Chinese companies, the market itself as well as consumer choices in the e-commerce market can change to low prices.”

However, there is a view that their business will not last long. It is difficult to continue the business from a long-term perspective as it focuses on attracting users and renewing sales rather than breaking even (BEP). Excessive marketing expenses are also pointed out as a problem. According to the industry, Temu’s marketing and promotion expenses amount to 500 million U.S. dollars on a quarterly basis.

According to Chinese media 36kr, the loss rate of Temu’s U.S. orders is 30% and an average loss of 40% based on global orders. “In this situation, break-even points have not even been put on the agenda,” the media said. “There is no internal goal for when to make profits.”

U.S. retailers are taking a beating from this. “The advent of Temu and Xuin has led to increased advertising costs in the global e-commerce industry,” said Ivy Yang, founder of Wavelet Street, a strategic consulting firm. “In the end, it is negative for consumers and we will have to pay higher prices in the future.” She added, “In order for giants like Amazon to survive the competition with China, they should compete with quality products.”

In the end, there is a possibility that the U.S. government will intervene. In June, former U.S. Trade Representative Robert Lighthizer said at a congressional hearing, “It was a serious mistake to raise the tariff standard,” adding, “2 million packages are coming into the U.S. every day, and we don’t know what’s inside.” He added, “The tariff-free standard should be lowered to $100.

If the U.S. government tightens its tariff policy to reduce the impact on its retailers, Chinese companies will not be able to sustain their current low-cost policy.

They are also expanding their influence in the Korean market. Shine and Temu are also encroaching on the market with low-cost policies in Korea. AliExpress, which entered the Korean market in 2018, grew rapidly and rose to the top of the fastball market. According to the Korea Customs Service, AliExpress’s fastball share is around 26%. In August, it recorded the largest number of users (5.51 million based on WiseApp) ever, rising to fourth place in the total number of apps used by Koreans. The user gap with Gmarket (6.05 million), which is ranked third, has narrowed to 540,000. Recently, the fashion platform industry is also paying attention to Shine as she is rapidly expanding her presence in Korea.

“Shine is trying to increase its influence in Korea,” a fashion industry source said. “It is showing a similar pattern to when Ali first entered Korea. Teenage users are more interested in Ali than those in their 20s and 30s.” “Ali was not a target to be checked at first, but look at what happened now,” he said. “It has become a favorite app for teenagers. The industry is also keeping a close eye on her as we don’t know how fast she will grow, although it is not enough to check her yet.”

JENNIFER KIM

US ASIA JOURNAL