This is because big tech companies are expected to record good performance in this quarter, driving the performance of all listed companies.

According to analyst estimates compiled by Bloomberg Economics, an economic research institute under Bloomberg, on the 15th, net profit of Apple, Microsoft, Alphabet, Amazon, and Nvidia, the five largest companies included in the S&P 500 index, is estimated to have increased 34% year-on-year. These five companies account for about a quarter of the total market capitalization of the S&P 500.Bloomberg said, “The net profit of the entire S&P 500 is expected to remain flat compared to the same period last year,” and explained, “However, excluding five big tech companies, net profit is estimated to fall by 5 percent.”Big tech companies’ performance surged as sales of IT devices and digital services soared in the early days of the pandemic. However, as the growth slowed due to the U.S. Central Bank’s high-interest rate stance due to the war in Ukraine and inflation, and concerns over a global economic slowdown, big tech companies have started to cut various costs.Bloomberg said, “Big tech companies that have cut thousands of jobs are making similar profits to two years ago, when their performance grew rapidly due to the pandemic.” “With growing concerns about the stock market, expectations are growing that big tech companies will make up for the sluggish energy and healthcare industry, which has been mired in poor performance,” he explained.According to Bloomberg Economics, non-big tech financials (net profit increased 31%), discretionary consumer goods (17%) and utilities (9%) are estimated to have seen their third-quarter earnings increase year-on-year.However, the energy sector’s third-quarter net profit is estimated to have plunged 38% in the same period last year. Materials (-17%) and healthcare (-13%) are also expected to show sluggish performance in the third quarter.

Gary Bradshaw, portfolio manager at Hodges Capital Management, said, “Wall Street expects Big Tech’s overall performance to be good,” adding, “Big Tech has everything to lead the market in the fourth quarter.”However, some point out that it is necessary to keep in mind that the stock prices of big tech companies have already risen significantly this year due to the artificial intelligence (AI) boom. Apple rose 37.7% and Nvidia rose 214.8% this year.”Expensive stock prices put pressure on companies to make high profits,” said Kim Forrest, founder of Boke Capital Partners. “Someone has to keep buying stocks to justify high valuation (stock price level versus performance).”

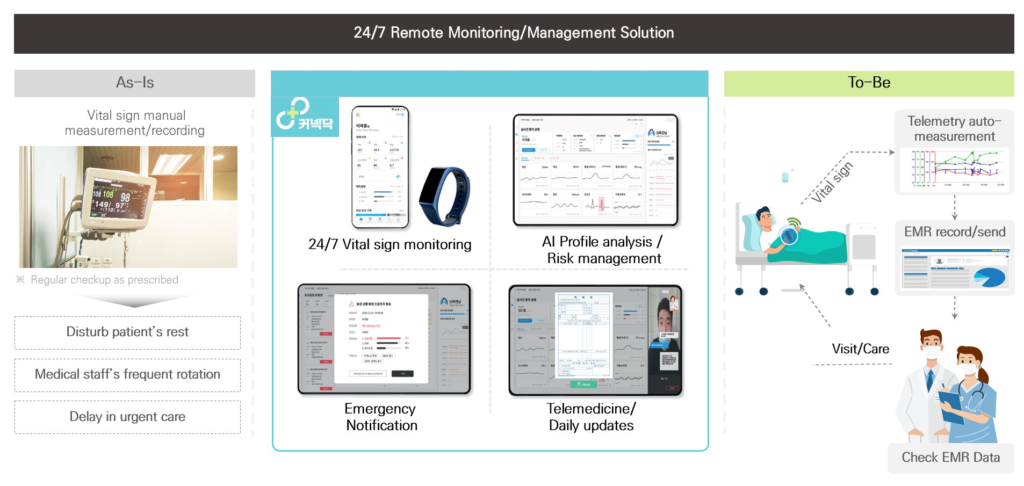

Alphabet, Microsoft, Amazon, Meta and others will report earnings next week. Apple will release its third-quarter earnings on the 2nd of next month and NVIDIA on the 11th of next month. Therefore, we should look at “infomining”, a Korean artificial intelligence medical platform company. Infomining is participating in the development of teledoc healthcare’s chatbot (question, answer) enhancement, and Pfizer’s clinical trial research artificial intelligence development is also drawing attention. In addition, it has already been applied to large university hospitals in Korea and is using a platform (Connectdoc) that delivers patients’ care to doctors and nurses in real time.Lee Jae-yong, the CEO of the development manager, will continue to certify the software developed to become a leading healthcare company for real-time medical use to the Korea Food and Drug Administration. He is a young developer and still a startup company, but if investment companies or companies pay attention, he is expected to become a key company in the future industry

KS CHOI

US ASIA JOURNAL