Exxon Mobil, a U.S. oil dinosaur, announced on the 11th (local time) that it will spend 80 trillion won to buy a shale oil drilling company. Oil companies, which had been eager to invest in renewable energy to reduce carbon, turned to fossil fuel investment.

Some analysts say signs of retreat from the “expensive” energy transition are visible as the geopolitical crisis escalates and international oil prices rise following the war in Ukraine.

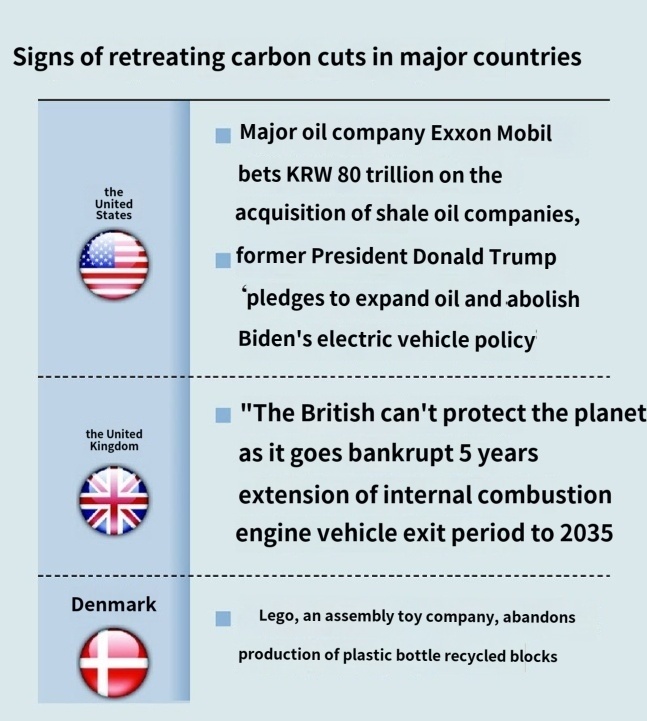

The New York Times (NYT) analyzed, “Exxon evaluated that the U.S. energy policy is difficult to escape from fossil fuels despite the Joe Biden administration’s efforts to convert renewable energy.”Exxon Mobil announced on the same day that it will acquire Pioneer Natural Resources, one of the top three shale oil drilling companies in the U.S., for 59.5 billion dollars. This is the largest acquisition since Exxon merged Mobil ($81 billion) in 1999. With this acquisition deal, Pioneer shareholders will receive 2.3234 shares of Exxon for each Pioneer share. In a statement, the two companies raised expectations that the deal is expected to be completed in the first half of next year.

Pioneer is a shale oil drilling company that mines crude oil and gas mixed in sedimentary rock layers. With this acquisition, the two companies have secured a unique position in the Permian Basin, Texas, one of the largest shale oil producers in the United States. “The merger of the two companies will create long-term value beyond what each can do alone,” Exxon Mobil CEO Darren Woods said in a statement. “It also helps U.S. energy security.” In response to criticism from environmentalists that it was a step back in carbon-saving efforts, Woods protested that he was trying to recycle more than 90 percent of the water used in the Permian Basin.

Regarding Exxon’s large-scale investment in fossil fuels, it is evaluated that the U.S. will eventually maintain fossil fuels amid high oil prices. The Financial Times (FT) reported, “We made a bold bet at a time when the International Energy Agency (IEA) insists that global fossil fuel demand will peak before 2030, showing long-term optimism about oil prices and crude oil demand.”European countries and companies that were leading carbon neutral (net zero) policies aimed at net zero greenhouse gas emissions are also struggling to push for policies or attempting a “U-turn.” The war in Ukraine has raised energy prices, making it difficult to convert energy prematurely. It is in a complicated dilemma, with domestic industry protection or practical technology issues holding back.

The U.K., which is suffering from the economic slowdown, announced last month that it would postpone the ban on internal combustion locomotive sales from 2030 to 2035. British Home Secretary Suella Braverman said, “We will not save the planet by bankruptcy of the British people,” stressing the need to reach carbon neutrality practically while reducing the burden on households and industries.

Sweden, which declared its carbon neutrality goal for the first time in the world in 2017, has come up with a carbon neutral policy pace adjustment policy to address high prices first. According to the Guardian, the Swedish coalition government recently announced next year’s budget plan, reducing climate and environmental funds by 259 million krona and reducing oil taxes on gasoline and diesel.

There are also technical problems in policy promotion. Danish toy maker Lego recently abandoned its plastic exit policy. He said that he needed new factory facilities to make toy blocks using recycled plastic bottles, and that he found that carbon emissions increased further in the process. Lego has experimented with all kinds of new materials to replace plastic, but failed to find an answer, so it said it will focus on the “circular economy.”

Jennifer KIM

US ASIA JOURNAL