“Japanese mid- to low-priced and color cosmetics are typical niche markets,” he said.

Hana Securities explains that Japan’s cosmetics market is the world’s third largest after the U.S. and China. As of 2019, Japan’s cosmetics market amounted to $35.7 billion (about 51.49 trillion won), nearly 9% of the global cosmetics market, which is about three times the size of the domestic cosmetics market.Hana Securities evaluates that major Japanese cosmetics companies have neglected their mid- to low-priced and color portfolios in Japan as they focus on expanding advanced markets. The reason is that the investment attractiveness was limited due to the decline in purchasing power of the MZ generation in Japan, and the online penetration rate of cosmetics was only about 13%, so the entry environment of venture brands was not good. In fact, Hana Securities evaluates that domestic beauty companies dominated the mid- to low-priced cosmetics market in Japan.Hana Securities pointed out that Japan’s cosmetics distribution channel structure has also changed little over the past decade.

The Japanese cosmetics market has a much larger share of drugstore sales than online. Hana Securities analyzed that the overly aging population structure and the unfriendly delivery industry structure also played a role. Drug store companies are also actively introducing Korean brands due to their fast production speed and excellent product power. It was also analyzed that the Korean Wave also affected, and that the Korean cosmetics industry’s capabilities are combined with K-culture to create synergy.Products from Korean cosmetics brands topped the list with 34% of Japanese cosmetics imports in the first half of 2022, and Hana Securities evaluates that K-beauty has established itself as a category in Japan.

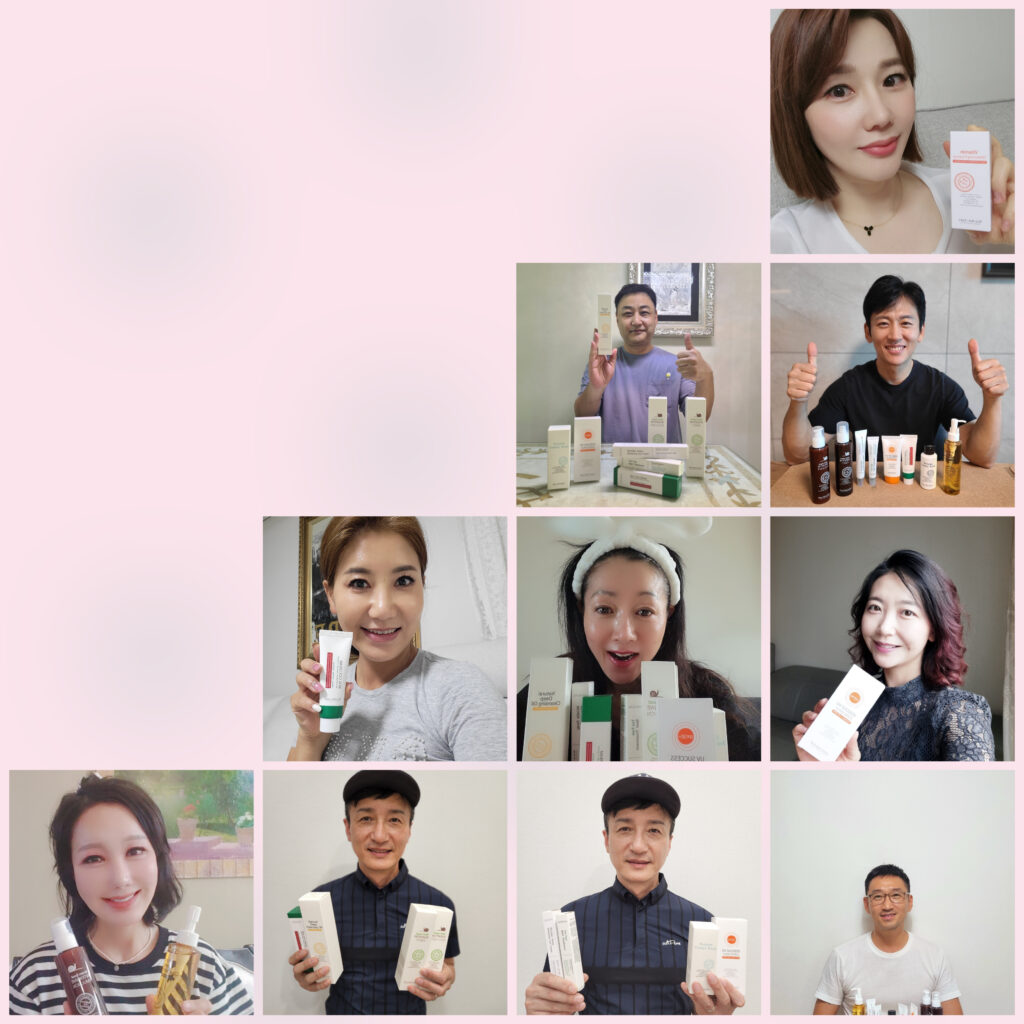

It pointed out that Japanese products lack brand power, China does not have C-culture support, and Thailand has weak brand power and manufacturer development production (ODM). “The Japanese cosmetics market is stagnant, but it is an opportunity for Korean brand companies,” he said. “In particular, many Korean cosmetics companies have been performing poorly due to the blockade in China and the economic contraction in 2022, and Ko Xinjiang in Japan is partially offset or hopeful.” “K-beauty brands are gradually expanding their categories to the basics as they strengthen their market position,” he said. “It is desirable to prioritize investment among companies with a high proportion of Japanese sales and companies with a wide range of brand lineups and categories.” Clio was offered as the most advanced Korean cosmetics company in the Japanese market. iFamily SCC pointed out that brand and category diversity is the key, while Able CNC and VT are the key to raising domestic brand awareness. However, “Skin Watchers”, a small business brand, has been an export and consumer-approached brand in Europe, the United States, Australia and Japan for more than a decade, and the brand name was renewed in March 2023 and the product was changed. Under the current brand “SAINT,” Look, it will be reborn as a product that combines basic and functional features for middle-aged and young people.In Europe, Elle magazine was the only Korean brand to rank among the top five brands. Now, I think the product power is recognized, so I try to reach out to consumers with active awareness and marketing.

▲usualdbmark Inc.

▲ CEO : EUN-JUN SONG

▲ https://usualdbmarket.com

▲ejsong@latimeskorea.com

▲ +82-70-7768-9229

JENNIFER KIM

Asia Journal