(Source from Reuters/Alamy)A 30-year-old Ivy League dropout who lived in a studio in San Francisco decided to sell his company, Figma, for $20 billion.

He is Figma co-founder Dylan Field.

Adobe, a leading U.S. software company well-known as Photoshop, recently announced that it will acquire Figma for $20 billion.

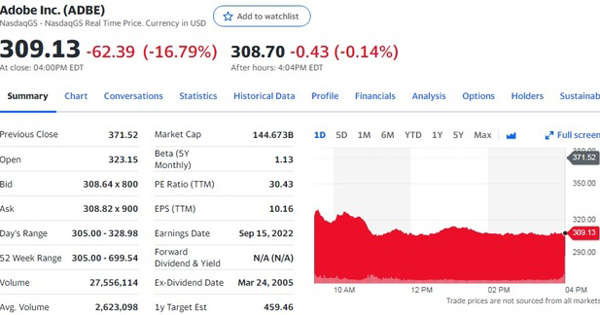

Adobe’s stock price plunged 17% on the day of the announcement because the acquisition price was too high, but Figma’s founder, Field, was on the money side.

A dropout from the Ivy League club Brown University, he is 30 years old this year. He became a billionaire 10 years after his company’s sale.

His exact stake is unknown, but he holds a significant portion of the company’s stake along with investment companies such as venture capital.

He lived in a studio in San Francisco not too long ago. He was an ordinary young man drinking a cup of coffee for a dollar on his way to work.

He is known to be very shy and has a very introverted personality, such as drinking alone at events hosted by venture capital companies.

He was not a prominent student until high school, he was in high school. He was on the verge of dropping out. The university also had to go to Brown University instead of Berkeley, which he wanted.But his talent began to bloom in Brown’s days. In his third year of college, he decided to apply for a fellowship run by a billionaire financier and receive $100,000 and started his business in earnest after dropping out of college.He initially released drone software to catch violent drivers. However, the company was not successful.After overcoming the experience of failure, he founded Figma in 2012 with his college friend Evan Wallace. Figma, a graphic editing platform where workers can design projects together, has grown tremendously through COVID-19.

In particular, unlike competitors’ products that only work on desktops and apps, it worked on various platforms simultaneously based on browsers, allowing it to work anywhere. On top of that, Figma spread rapidly among designers because it was easier to use and collaborate than Adobe.This was a headache for rival Adobe. In the end, Adobe decided to take over Figma.Adobe announced on the 15th that it would acquire Figma for $20 billion. Adobe’s stock price plunged 16.79% from the previous trading day to $309.13 on the New York Stock Exchange.

This is attributed to the high acquisition price paid by Adobe to Figma.

Wall Street experts say the acquisition price can be rationalized in 2021 when technology stocks hit the upper limit, but the acquisition price is excessive in 2022 when technology stocks are plunging.

Adobe shares slumped, but Field hit the jackpot. A shy young man who lived in a studio has become a billionaire for the first time in 10 years.

Field was initially preparing for Figma IPO, but eventually chose to sell it. As the New York Stock Exchange entered the bear market (falling ground) and the IPO market froze, he seemed to have judged that the sale was better than the venture of listing.

JENNIFER KIM

ASIA JOURNAL