According to TrendForce, a market research firm, global foundry market sales are expected to reach $75 billion which is a 23.8% increase from 2019. Investment in 5G smartphones and telecommunication infrastructure is increasing, and the use of automotive electronic equipment, AI (Artificial Intelligence) and HPC (High-Performance Computing) is spreading, and demand for game consoles has increased due to the spread of COVID-19.

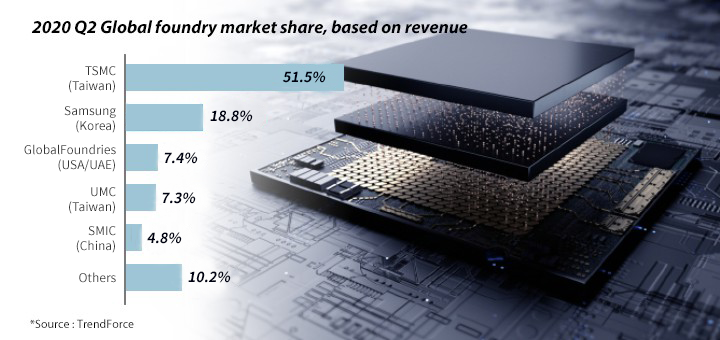

Foundry companies that produce these system semiconductors grew rapidly in 2020. TSMC’s sales are up 21% from last year to $12.55 billion in 2020. Market share is expected to grow 51.5% in the second quarter of 2020, 53.9% in the third quarter and 55.6% in the fourth quarter. It is estimated that Samsung Electronics’ sales are also growing at a rapid pace, increasing 25% year-on-year in the fourth quarter of 2020. However, its market share is only 18.8% which is significantly lower than TSMC.

Investment competition among foundry companies is also intensifying. Taiwan’s TSMC announced that it will increase the amount of facility investment by 50% in 2021 compared to the previous year, and Korea’s Samsung Foundry is also expected to increase significantly compared to the previous year. Meanwhile, Samsung Electronics announced ‘Semiconductor Vision 2030′ in April of 2019. It is planning to invest $119 billion ($65 billion in R&D and $54 billion in infrastructure) by 2030 to become the world’s top player in the non-memory (system semiconductor) field. Samsung Electronics’ Foundry is reducing dependence on Samsung LSI, its biggest customer, and expanding its customers to large fabless (technology and design sector) companies such as nVidia and Qualcomm, and China and various fabless (technology and design sector) companies.

As foundry companies’ sales increased, global semiconductor equipment companies (Applied Materials, Lam Research, TEL, ASML, etc.) also performed well. Japanese semiconductor equipment maker, TEL (Tokyo Electron Ltd.) posted $3.35 billion in sales in the second quarter of 2020, $702.25 million in operating profit, and $3.17 billion in sales in the third quarter of 2020. TEL is balanced with 50% of sales of semiconductor equipment and 50% of non-memory (system semiconductor). NAND-oriented memory semiconductors have returned to the investment cycle, and the growth of foundry-oriented system semiconductors is accelerating, driving TEL’s performance.

Perceptual fluctuations in system semiconductors (non-memory) have a significant impact on the global economy. There are no unrelated places such as 5G smartphones, communication infrastructure, artificial intelligence semiconductors, high-performance computers, displays, Internet of Things, energy, robots, machines, defense, safety, transportation infrastructure, and self-driving cars.

Like the emergence of the Internet and smartphones in the early 20th century, there is a good reason to pay attention to the trend of system semiconductors that will greatly change our daily lives in the next five to ten years.

Mike Choi

Asia Journal

(Los Angeles Times Advertising Supplement)